Market Analysis with Mike Ermolaev

Continuing our tradition of weekly market analysis hosted by crypto journalist and analyst Mike Ermolaev, this marks the 16th edition of GoMarket Weekly. With Bitcoin's value taking a recent hit, investors are scratching their heads about what's causing this drastic change in market sentiment. So let's find out the major forces driving this Bitcoin market movement. Along with considering Ethereum's current standing, we'll explore recent regulatory developments and discuss the latest Bitcoin mining insights – knowledge that every participant in the industry should have.

Shifting Market Sentiment and Long-Term Holder Influence

Bitcoin's price has experienced a significant decline over the past week, ranging as low as $59,495 to a high of $64,593. This downturn has been a bitter pill to swallow for many market players, especially with the all-time high of $73,737 in mid-March still fresh in their memories.

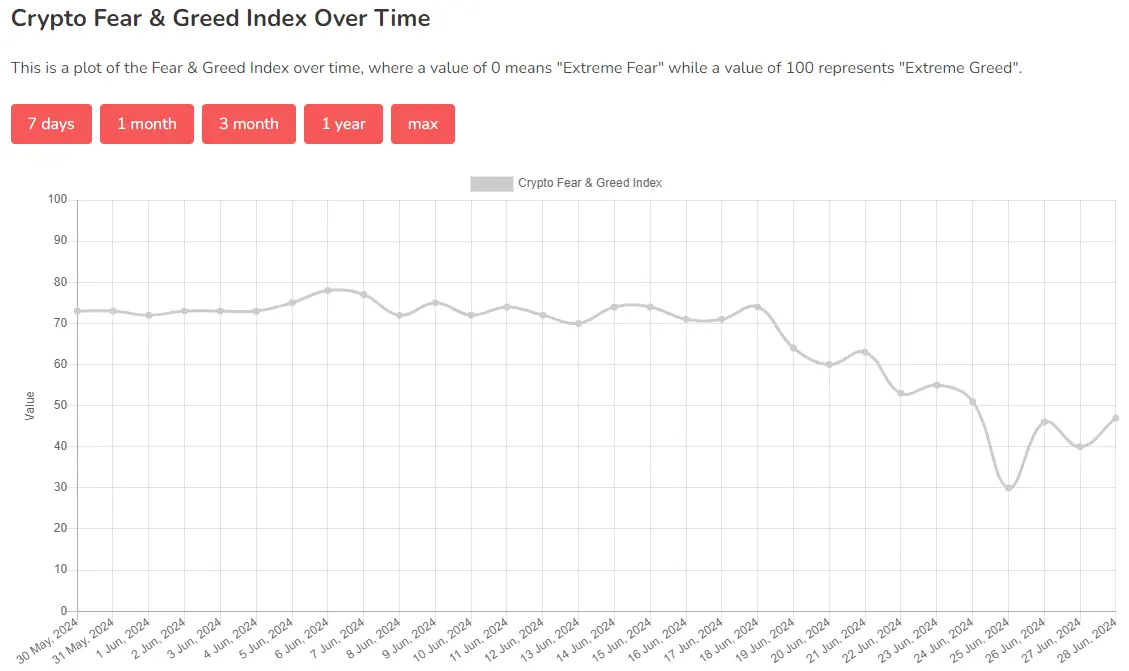

Unsurprisingly, this decline mirrored a dramatic shift in market sentiment, where the Crypto Fear and Greed Index, a key indicator of market emotions, plummeted from 63 last week to 47 currently, tumbling off a "Greed" cliff and landing just on the edge of "Neutral" territory.

Source: Alternative.me

The recent Glassnode report reveals that the demand momentum has turned negative, with the cost basis of short-term holders now higher than the current price, risking further investor confidence decline. Despite only accounting for 4%-8% of daily trading volume, long-term holders realize 30%-40% of profits, meaning they sell fewer coins but make substantial gains from these sales.

Since mid-June, BTC price has remained below the cost basis for short-term holders (both 1-week to 1-month and 1-month to 3-month cohorts). Historically, when the Bitcoin price stays lower than the cost basis of short-term holders, it suggests a period of market weakness, which could lead to deeper and longer corrections.

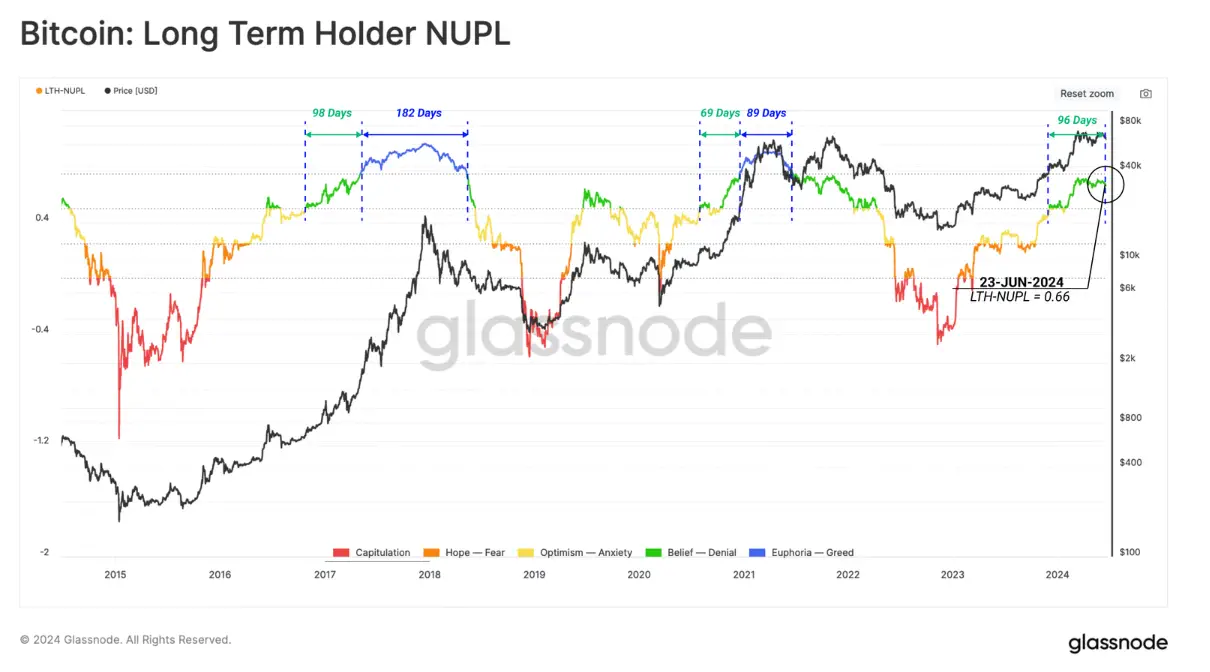

However, the good news is that the Long-Term Holder Net Unrealized Profit/Loss (LTH-NUPL) is currently at 0.66, indicating a pre-euphoria phase similar to the 2016-17 cycle. This suggests we might be on the verge of a significant price increase if the market follows historical patterns.

Source: Glassnode

Fundamental Reasons Behind the Market Weakness

Among the major reasons behind market optimism's decline is the cooling demand for spot Bitcoin ETFs amidst uncertainty over the Fed’s monetary policy, with notable outflows continuing. According to data from Farside Investors, during the period from June 21 to June 27, the total inflows amounted to $183.1 million, while the outflows reached $615.5 million.

Data from Santiment confirms the trend of crypto aversion among institutional investors, showing that big transactions (over $100,000) dropped by 42% in just a few days.

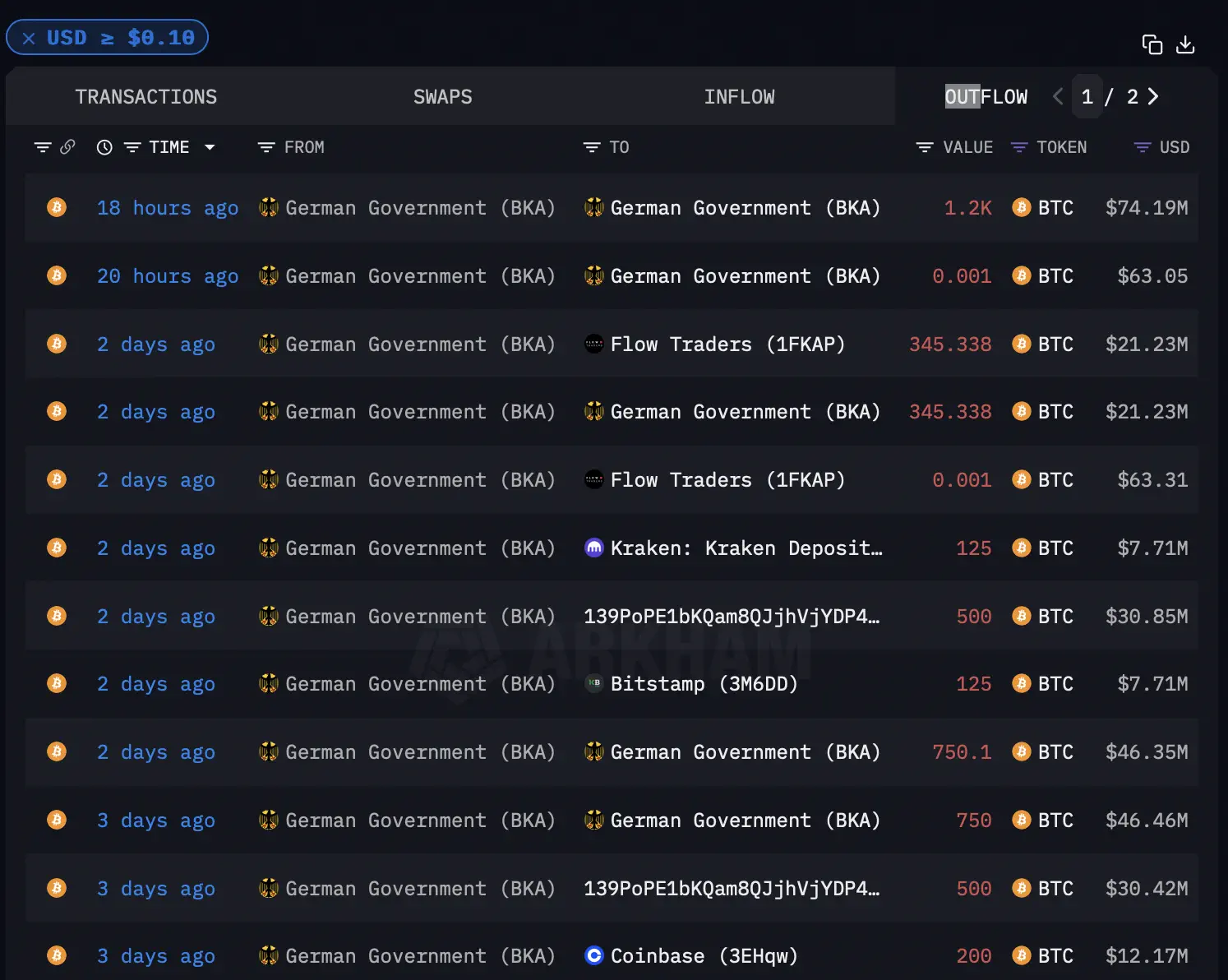

Another reason for the decline is the recent significant activity involving Bitcoin transfers from the German Federal Criminal Police Office (BKA). According to Arkham data, in the past few days, the BKA transferred 345.338 BTC to Flow Traders, valued at approximately $21.23 million, and 125 BTC each to cryptocurrency exchanges Kraken and Bitstamp, valued at $7.71 million each. Additionally, the BKA transferred 500 BTC to an unknown wallet, worth $30.85 million, and 200 BTC each to Coinbase and Kraken, valued at $12.17 million each.

These actions follow previous sales where the BKA dumped approximately $170 million worth of Bitcoin in the past week. The Bitcoin being sold by the BKA was originally confiscated from operators of the movie piracy website Movie2k, with the total amount seized being nearly 50,000 BTC, valued at over $2 billion at the time. As of the latest data, the German Government (BKA) holds 46,156 BTC, valued at approximately $2.83 billion. This active management of Bitcoin holdings put persistent downward pressure on the cryptocurrency, tanking market morale and sliding prices along with it.

Source: Arkham Intelligence

Adding to this, the U.S. government transferred 3940.28 BTC, seized from a narcotics trafficker, to Coinbase Prime. The combination of mammoth transactions and investor uncertainty has been unsettling for the market, leading to the recent decline.

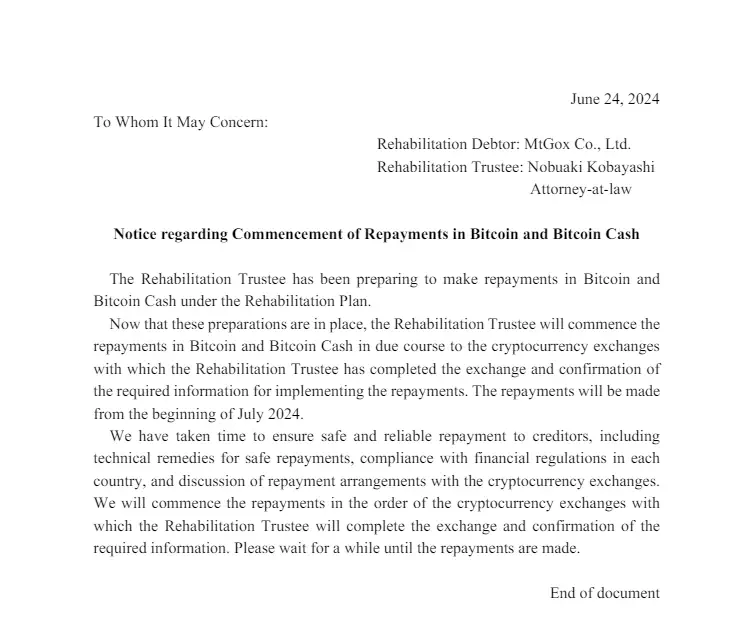

Furthermore, Mt. Gox, the defunct Bitcoin exchange, announced it will begin repaying its creditors, and will begin returning assets to customers in July 2024, more than a decade after it was hacked. This long-awaited repayment raised fears of a potential flood of Bitcoin hitting the market as creditors might rush to cash out, adding to the market's volatility.

Source: Mtgox

Finally, the cascading liquidation of BTC options on the derivatives market also played a crucial role in amplifying the decline.

Ethereum's Dominance in DeFi and Upcoming ETF Developments

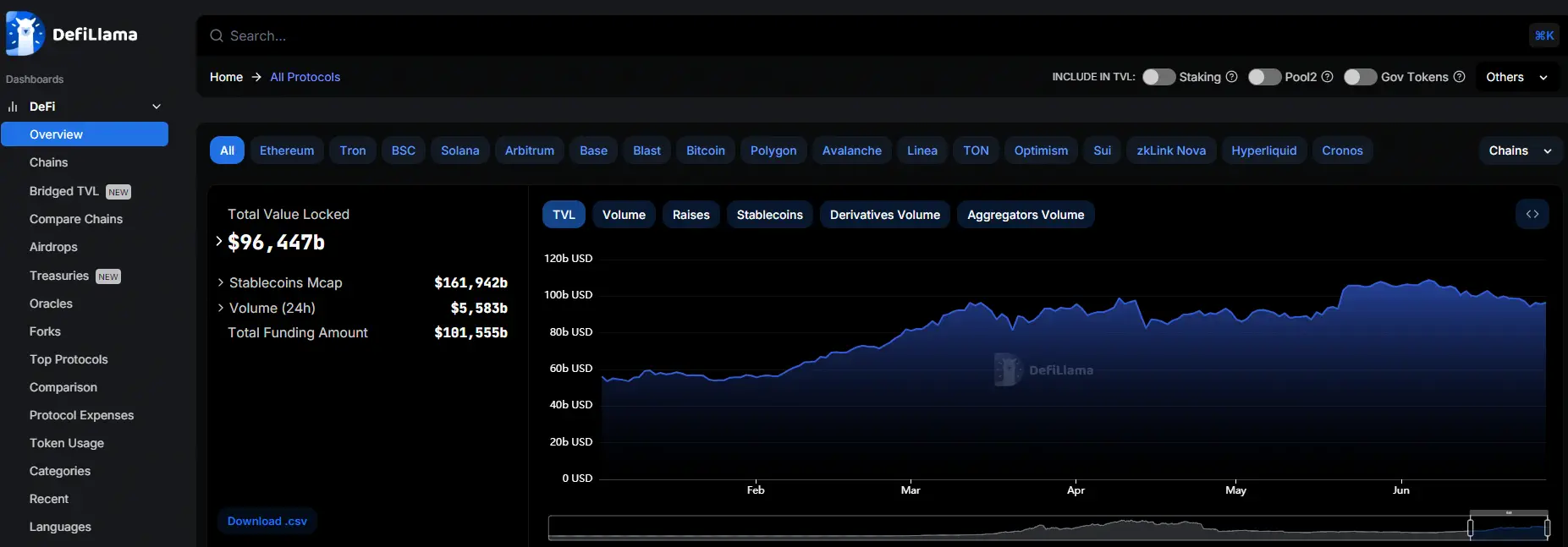

Ethereum traded within a range of $3,259– $3,538 over the past seven days. In June 2024, the total value locked (TVL) in DeFi protocols surpassed $100 billion (although it dipped slightly after that) with Ethereum maintaining its dominance, holding around 60% of the sector. Ethereum's stronghold in the DeFi space continues to bolster its value proposition.

Source: DeFiLlama

SEC Chair Gary Gensler stated that the launch process for spot Ethereum-ETFs is "going smoothly" during the Bloomberg Invest Summit. While he did not specify the listing date, he hinted that it depends on the issuers' readiness to disclose necessary information. That same day, VanEck submitted a Form 8-A for its Ethereum ETF, indicating that the fund could soon be listed and traded on a major exchange. With the upcoming Ether ETFs, the second largest cryptocurrency by market capitalization, is likely to continue to attract both retail and institutional investors.

Ripple CEO's Critique of SEC Policies

Ripple CEO Brad Garlinghouse expressed his agreement with Mark Cuban's earlier remarks that SEC Chair Gary Gensler's policies might impact Joe Biden's chances in the upcoming presidential elections. Garlinghouse criticized Gensler's statements at the Bloomberg summit, calling them "absolute nonsense".

Garlinghouse posted, "This slander about 'all crypto execs going to jail' from the man who completely missed FTX (and actually cozied up to SBF), and wasn’t even invited to the DOJ announcement about Binance. If he was really 'working for the American people' as he says, he would have been fired a long time ago".

U.S. Congressman Proposes Bitcoin Tax Payments

Meanwhile, U.S. Congressman Matt Gaetz introduced legislation to allow federal income tax payments to the IRS using Bitcoin. Inspired by El Salvador's policy, where Bitcoin is legal tender, Gaetz's bill seeks to amend the Internal Revenue Code of 1986.

“My groundbreaking legislation will modernize our tax system by allowing federal income tax to be paid with Bitcoin. By enabling taxpayers to use Bitcoin for federal tax payments, we can promote innovation, increase efficiency, and offer more flexibility to American citizens. This is a bold step toward a future where digital currencies play a vital role in our financial system, ensuring that the U.S. remains at the forefront of technological advancement,” Congressman Gaetz said.

Miners Adjusting Strategies

According to Glassnode analyst James Check, "miners are likely to be distributing some of their treasury but it may not be a complete and total fire sale," suggesting that miners are selling just enough to cover costs. Additionally, the "hash ribbon inversion" indicates stress in the mining sector, with about a 4% decline in hash rate, implying that "5% of the mining hash rate is struggling at the moment." This assessment suggests that while there is some sell-side pressure from miners, it is not at a level indicative of severe capitulation.

Similarly, Mitchell Eskew, Head Analyst Co-Author and Editor of Blockware Intelligence Newsletter, pointed out that most miners continue to operate profitably despite the recent price decline.

Conclusion

In this edition of GoMarket Weekly we’ve tried to go straight to the source to figure out what's driving the market. It turned out that key obstacles were weak interest in Bitcoin ETFs, a cloudy forecast for the Fed's monetary policy, and an investment exodus with large transactions dropping by 42% that saw many jump ship.

Also, significant Bitcoin transfers by the German Federal Criminal Police Office (BKA) and U.S. government have further pressured the market. Additionally, upcoming Mt.Gox repayments are expected to add to the volatility. Ethereum's stronghold in DeFi remains unshaken despite the roadblocks, and Ethereum ETFs could supercharge the currency's market power. A tipping point for crypto's mass appeal may be just around the corner, now that Congressman Matt Gaetz is fighting to let Americans pay their taxes in Bitcoin. Furthermore, insights from Glassnode and Blockware analysts highlight that miners continue to operate effectively, indicating resilience.

The crypto market's drama never ends, and we've got the inside story. Tune in next week for our weekly update, where Mike Ermlolaev separates the signal from the noise and gives you the best bits.