Market Analysis with Mike Ermolaev

Welcome to the 12th edition of GoMarket Weekly! In an exclusive contribution to the GoMining community, crypto expert and journalist Mike Ermolaev gives a breakdown of the latest developments in the cryptocurrency world. This week, we explore Bitcoin’s strong technical performance and long-term accumulation trends, Ethereum’s potential boost from ETF approvals, and key regulatory shifts in the United States. Additionally, we cover significant updates in global crypto mining. Dive into these exciting developments and understand their impact on the crypto market! Let’s GoMarket!

Bitcoin’s Technical Strength and Long-Term Accumulation

Bitcoin has been trading within a range of $67,700 – $70,425 over the past seven days, still demonstrating some indecisiveness in breaking through its March all-time high of $73,737.

From a technical perspective, Bitcoin's recent performance has been robust. The 5-day moving average stands at $68,369, while the 20-day moving average is $66,962, reflecting a solid 8% increase.

Additionally, the Relative Strength Index (RSI) for the 14-day period has increased to 49.05%, signifying strengthening buying interest and hinting at a possible continuation of the upward trend. The stable 24-hour trading volume, now at $113.38 million, underscores sustained market participation, which is crucial for supporting further price increases. Bitcoin appears poised for continued strength, with the potential to revisit recent highs and beyond, aiming towards $70,667 and $71,819 as its immediate resistance levels.

Source: TradingView

From a fundamental perspective, Bitcoin exchange-traded funds (ETFs) saw a remarkable net inflow of $374 million over the past week based on the Farside data, indicating TradeFi demand remains strong.

Also, according to the latest Glassnode report, long-term investors (LTHs) are showing signs of reduced spending pressure. Earlier this year, especially around the all-time high (ATH) of $73k in March, these investors sold their coins at elevated prices after enduring the downside volatility of the previous bear market. However, they are now returning to accumulation patterns for the first time since December 2023, adding around +12k BTC per month to their holdings after a period of heavy selling in March.

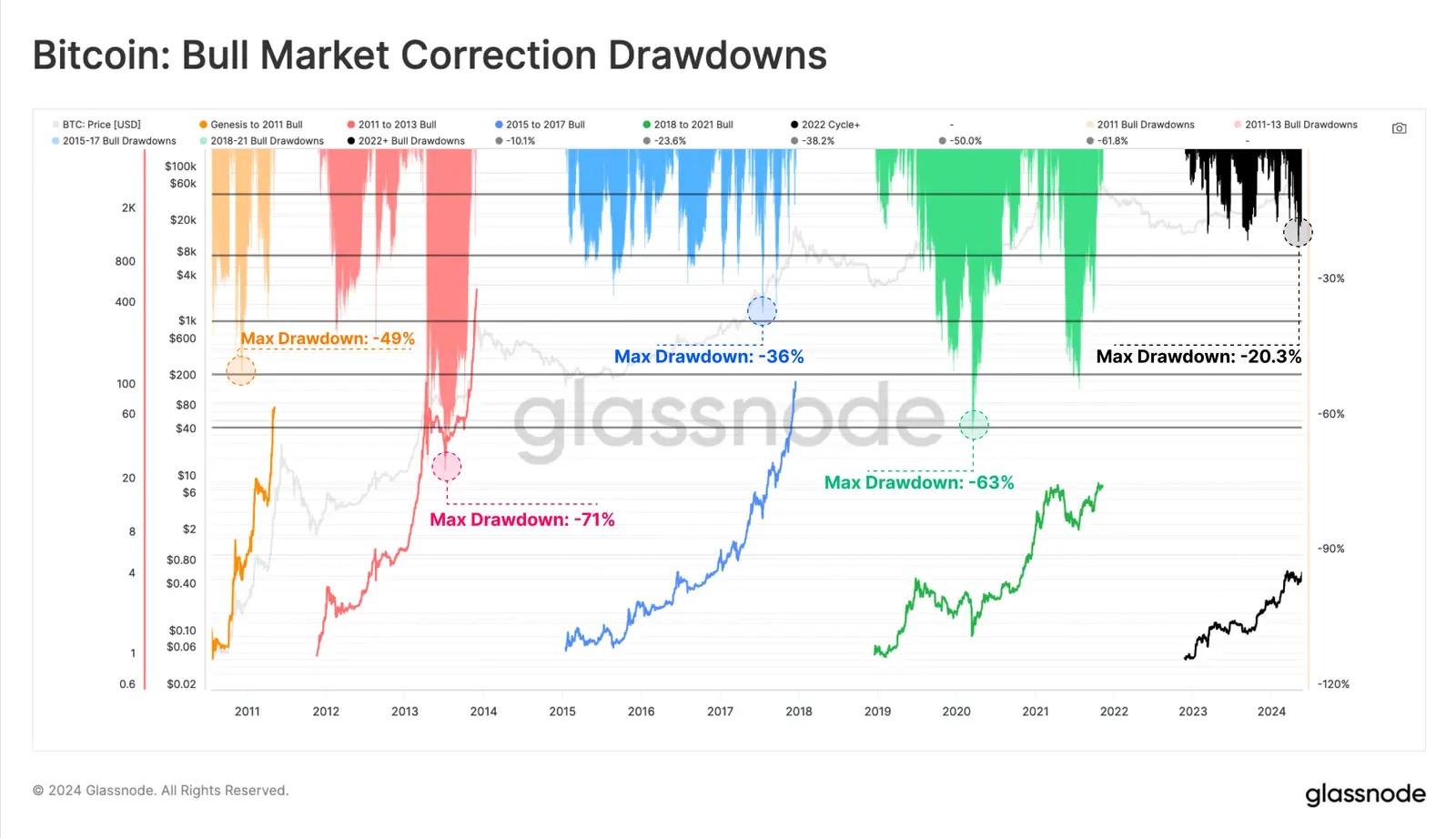

Glassnode also notes that the recent uptrend in Bitcoin appears to be spot-driven and strikingly similar to the 2015-17 bull market which occurred during the original crypto’s infancy before derivatives were available. The launch and inflows into US Spot ETFs support this view.

Source: Glassnode

Ethereum’s Potential Upward Trend Amidst ETF Approval

Over the past week, Ethereum (ETH) has been trading between $3,664 and $3,959. It’s currently facing resistance around $3,869 and $3,919 levels. Recent strength is evidenced by its relative closeness to its one-month high of $3,972, underscoring the market's potential to maintain and surpass these gains.

Source: TradingView

From the fundamental perspective, the unexpected approval of spot ETH ETFs by the SEC may provide the catalyst necessary to stimulate Ether’s strength by boosting interest and investment in the second largest crypto by market cap.

Among the latest Ether ETFs developments, BlackRock updated its S-1 filing, taking a step closer to its launch. The updated filing reveals that the Seed Capital Investor, an affiliate of BlackRock, purchased 400,000 shares at $25 each on May 21, resulting in a $10 million investment.

Biden Campaign’s "Too Little, Too Late" Crypto Engagement; Mastercard's Crypto Reach Expansion

In the regulatory sphere, as we suggested in the previous analysis, the tone shift in the Biden Administration's statements on crypto has now materialized into action. President Joe Biden’s re-election campaign has started engaging with crypto industry players for guidance on "crypto community and policy," sources with direct knowledge told The Block.

According to sources, following anti-crypto statements, including Biden's vow to veto the repeal of SAB 121, the campaign recently approached several crypto experts for insights—hinting at an increased curiosity about cryptocurrencies. It’s blindingly obvious that reacting to Trump's recent support for cryptocurrency including their announcement of taking crypto donations, the Biden campaign has adjusted its strategy. So now both campaigns are showing more openness to the crypto industry. Despite gaining approval from numerous crypto enthusiasts, there's a faction that remains unconvinced, considering the effort "too little, too late."

Meanwhile, the adoption of digital currencies has taken another step forward, as Mastercard launched its Crypto Credential service, where users no longer have to deal with complex blockchain addresses; they can now send and receive crypto using straightforward aliases. With this new rollout already active on several exchanges, users can smoothly handle blockchain transactions all over Latin America as well as Europe. This is a notable advancement for broader crypto usage which might later include applications like non-fungible tokens (NFTs) or ticketing.

Russia’s Mining Growth, El Salvador's New Crypto Hub, and US Bitcoin Derivatives Launch

The Russian crypto mining sector is projected to grow by 20-40% in 2024, driven by low electricity costs and minimal regulatory oversight, according to Kommersant, citing Sergei Bezdelov, the Director of the Industrial Mining Association. The country's mining industry doubled in size in 2023, with domestic Bitcoin miners producing around 54,000 BTC. Despite the lack of legal status for mining in Russia, the favorable climatic conditions and potential repurposing of production sites, particularly in Siberia, contribute to the positive growth dynamics. However, the sector remains largely unregulated, with ongoing discussions about potential legalization and regulation to address grid load and taxation.

Adding to this, Bezdelov noted in a recent interview, "At present, 2.7 gigawatts of electricity are spent on mining in Russia, which is comparable to the consumption of a small country. Approximately 60 percent of the capacity is occupied by legitimate industrial mining, while 40 percent is taken up by gray and black mining, which involves violations."

Furthermore, Ocean Mining, a Bitcoin mining company backed by Jack Dorsey, has adopted El Salvador as its global headquarters, signaling a strategic move to leverage the country's crypto-friendly environment. "This decision by the OCEAN Mining team reaffirms that the Bitcoin culture we are building in El Salvador is providing the tools that entrepreneurs around the world need to thrive in a Bitcoin economy. We welcome OCEAN and all other companies working to advance Bitcoin adoption," Bitcoin Office's head, Stacy Herbert said in the announcement.

Welcoming significant players such as Ocean Mining demonstrates how committed El Salvador is to positioning itself at the forefront of the Bitcoin economy. With such an inspiring step forward, other crypto enterprises might consider moving there too or enlarging their footprint locally.

And last but not least, the launch of the first-ever Bitcoin mining derivative product on a regulated US exchange marks another significant milestone. Luxor Technology Corporation and Bitnomial, Inc. have introduced Hashrate Futures on Bitnomial’s US-based derivatives exchange. This development offers investors a new tool to access a derivative directly tied to Bitcoin mining hashrate. For the first time, traders can engage with regulated Bitcoin mining derivatives — pushing digital assets further into everyday financial systems.

Conclusion

With all the recent activity, it's clear that cryptocurrencies are evolving faster than ever before. Bitcoin's robust technical performance and long-term accumulation patterns suggest strong future growth, while Ethereum’s potential boost from spot ETF approvals could narrow its performance gap with Bitcoin. With Biden ramping up engagement with cryptocurrencies and Mastercard introducing its new Crypto Credential program, there is also clear evidence that digital assets are gaining traction. Add to this Russia’s anticipated growth in mining activities and El Salvador positioning itself as a crypto hotspot — plus the introduction of a Bitcoin mining derivative product on a regulated US exchange — and you can see why many believe there's bright potential ahead for crypto. Don't miss our update next week as we explore the latest trends and developments in the market.