Market Analysis with Mike Ermolaev

Welcome to the 15th edition of GoMarket Weekly! Mike Ermolaev, a crypto expert and journalist, is here to break down the latest developments in the cryptocurrency world exclusively for the GoMining community. This week, we explore what is slowing Bitcoin’s growth, Ethereum’s evolving market dynamics, significant regulatory updates, and major trends in Bitcoin mining. Dive into these exciting developments and understand their impact on the crypto market! Let’s GoMarket!

Bitcoin's Consolidation Amidst Significant ETF Outflows and Investor Indecision

Bitcoin has been trading within a range of $63,594-$67,037 over the past seven days. During this period, U.S. spot Bitcoin exchange-traded funds (ETFs) experienced total inflows of $5.9 million and outflows of $602.5 million, resulting in net outflows of $596.6 million from June 14 to June 21, according to Farside Investors' data.

Analysts at Bitfinex observe that the Bitcoin market has entered a consolidation phase, characterized by gradual selling from miners (see the article's final section for a breakdown of miner reserves), whales and long-term holders (LTHs). These market players remain the largest holders of Bitcoin, exerting a more significant influence on Bitcoin prices than the ETF outflows, which are primarily reactive to price changes rather than market-predicting.

One of the metrics to demonstrate whale activity is the Coinbase Premium Index, which tracks the percentage difference between the price of BTC on Coinbase Pro, which is popular among miners and ETF issuers, and the average price on other major exchanges. This indicator has primarily been negative, suggesting that the selling pressure comes from investors on the platform.

Source: CryptoQuant

Glassnode further supports this view, noting that Bitcoin has transitioned to range trading, and despite sideways price action, investors remain profitable with an average unrealized profit of around 120%. The market has reached an equilibrium where demand is sufficient to absorb sell-side pressure but not strong enough to drive further upward growth. Volumes across all market facets, including on-chain transactions, spot trading, and futures, have declined markedly, reflecting a lack of speculative interest and heightened investor indecision. Long-term holders are distributing fewer coins to exchanges and institutional investors are increasingly engaging in market-neutral cash-and-carry basis trades. Overall, this equilibrium has led to stable prices and a notable lack of volatility, suggesting that a decisive price movement is needed to stimulate renewed market activity.

ETH Gains Regulatory Relief and Anticipates ETF Approval Boost

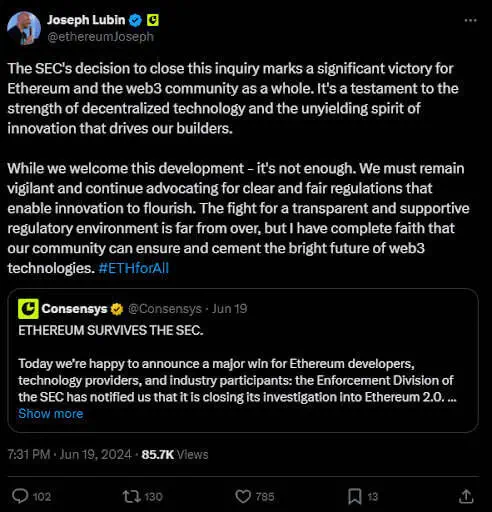

Ethereum (ETH) has been trading between $3,384 and $3,632, displaying quite a bit of resilience. In a major regulatory development removing a significant burden from Ethereum, the SEC has dropped its investigation into Ethereum 2.0 without filing charges, as confirmed by ConsenSys CEO Joseph Lubin.

Bloomberg analyst Eric Balchunas predicts that the launch date for ETH ETFs might be moved to July 2nd, sending ripples of excitement throughout the community and potentially triggering a significant upswing in prices.

Supporting this outlook, QCP Capital suggests that even a modest demand, accounting for just 10-20% of the inflows seen in spot Bitcoin ETFs, could have a substantial impact on Ethereum prices. The price of Ethereum is likely to get a serious boost if current trends continue, with $4,000 a likely stopping point before the cryptocurrency makes a run for $4,800. If predictions are correct, that's precisely what's on the horizon – a reality where Ethereum could potentially challenge Bitcoin's dominance, leaving an indelible mark on the crypto world.

New EU Stablecoin Rules, South Korea’s Token Checks, and Australia’s Bitcoin ETF Launch

In the European Union, under the MiCA regulations, new requirements for stablecoins will come into effect in the EEA starting June 30. These regulations impose stricter standards for fiat-backed cryptocurrencies, requiring issuers and operators to obtain licenses, maintain stability, and fully disclose information to customers.

In South Korea, the Financial Services Commission (FSC) will implement the country's first law on virtual asset user protection starting July 19, requiring 29 licensed cryptocurrency exchanges to review the listing status of over 600 virtual assets. These exchanges must establish internal evaluation bodies to assess coin reliability, user protection, technology, security, and regulatory compliance, with alternative criteria for assets like Bitcoin. Coins failing to meet standards will be designated as cautionary and may face delisting. Reviews will occur every six months, followed by maintenance reviews every three months. The FSC is also forming a new bureau for comprehensive virtual asset regulation and policy oversight.

Meanwhile, in Australia, VanEck has introduced a Bitcoin ETF to Australia’s main stock exchange, expanding the reach of cryptocurrency investment products.

Bitcoin Miners Maintain Profitability

US-listed Bitcoin miners have reached a market cap of $22.8 billion amidst a rising hashrate share and AI opportunities, outperforming Bitcoin in the first half of June, JPMorgan said in a recent research report. Amidst the decline in mining difficulty, miners maintain profitability even as the network hashrate fluctuates.

Source: CryptoQuant

However, Bitcoin miner reserves have dropped to their lowest in 14 years, recorded at approximately 1.816 million BTC as of June 20, 2024.

Source: CryptoQuant

Meanwhile, miner reserves measured in United States dollars have remained relatively close to their all-time high of approximately $135 billion. As of June 20, 2024, the miner reserves were recorded at about $117.8 billion. This reflects a typical market response to halving pressures on miner margins.

Conclusion

In this edition of GoMarket Weekly, we've taken a closer look at the cryptocurrency market's latest puzzle: Bitcoin's stuck in range-bound trading, while big players like miners and whales are unloading their assets, and hefty ETF outflows are only complicating things further. Ethereum has demonstrated resilience, particularly with the SEC dropping its investigation into Ethereum 2.0, and the upcoming approval of ETH ETFs which could significantly boost prices. Regulatory updates in the EU and South Korea are set to impose stricter standards and comprehensive reviews for cryptocurrencies, while Australia sees the introduction of a Bitcoin ETF by VanEck. US-listed Bitcoin miners have achieved a market cap of $22.8 billion despite declining BTC miner reserves, showcasing their ability to stay profitable amid fluctuating network conditions. As the market teeters on the edge of change, we're on high alert for major shifts in the coming weeks. Get ready for the next dose of marketing insights, coming your way in our next GoMarket Weekly installment!