Market Analysis with Mike Ermolaev

We're back with the 13th edition of GoMarket Weekly. Exclusively for the GoMining community, Mike Ermolaev, a seasoned crypto market analyst and journalist known for his interviews with notable figures in the cryptocurrency world and beyond, will provide a comprehensive update on the latest industry developments. We’ll explore Bitcoin's meteoric rise in open interest, Ethereum’s potential surge with ETF approvals, as well as significant updates on the regulatory front and global crypto mining. So, what next for crypto with this sea of change? Let’s GoMarket and explore!

Bitcoin Futures Open Interest Hits New High as Potential for All-Time High Grows

Over the past seven days, Bitcoin traded within the range of $67,120 to $71,713. On June 7, 2024, Bitcoin futures open interest skyrocketed, hitting a new high at 524K BTC. The largest contributors to the total open interest in BTC futures are Coinbase with 63%, CoinEx with 45%, CME with 30%, and Binance with 22%. Other significant shares include Bybit with 14%, Bitget with 11%, and OKX with 8%.

Source: CoinGlass

Digital asset trading firm QCP Capital suggests that Bitcoin could potentially exceed its all-time high this month, in light of a disappointing jobless claims report and the upcoming CPI release next week. “There may also be added momentum to the rally as the market prices in rate cuts," QCP stated in its Thursday market update.

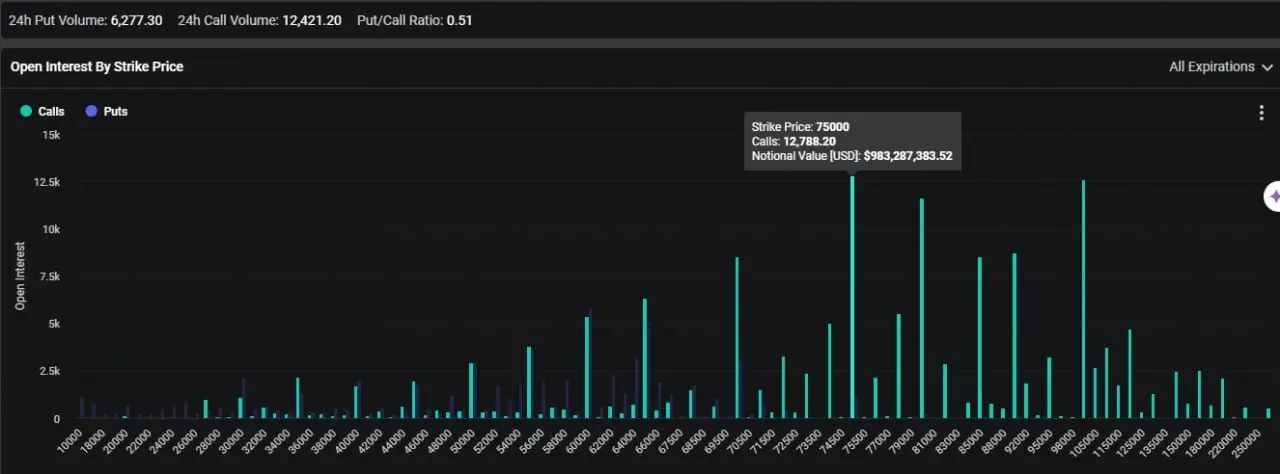

Data from the Deribit derivatives exchange shows that the largest cluster of Bitcoin options open interest for June's end-of-month expiry are calls at a strike price of $75K, with approximately 12,788 contracts valued at $983 million. Additionally, significant open interest is observed at strike prices of $80K and $100K, with around 11,645 and 12,617 calls, respectively, valued at $895 million and $970 million. This indicates a collective anticipation of drastic price shifts in the original cryptocurrency.

Source: Deribit

Still, despite the general optimism, some traders caution against potential whipsaw action, where a sudden price spike could occur in the opposite direction of the current trend.

Meanwhile, according to Farside data, between May 31 and June 7, 2024, Bitcoin ETF inflows were significant across various funds. IBIT saw the highest inflow with $274.4 million, followed by FBTC with $378.7 million. ARKB had $138.7 million, and BITB recorded $61.0 million. Smaller inflows were noted for BTCO with $3.6 million, BRRR with $1.6 million, HODL with $4.0 million, and BTCW with $1.1 million. In contrast, GBTC experienced an outflow of $37.6 million. Overall, the total inflows for this period amounted to $1.77 billion.

The macro setup for BTC appears to be strong. Initial claims for state unemployment benefits rose faster than expected, increasing by 8,000 to a seasonally adjusted 229,000 for the week ending June 1, compared to economists' forecast of 220,000 claims. Additionally, the U.S. 10 Year Treasury Note has decreased by approximately 3.34% over the past two weeks, from May 23 to June 5. These macro factors contribute to rising expectations for rate cuts, which are anticipated to increase liquidity and investment demand, potentially providing strong support for the BTC price.

Looking into network fundamentals, Bitcoin does not currently appear to be overvalued according to the Thermo Cap Ratio indicator, which measures the cumulative value of all Bitcoin mined to date against the current price, representing the total investment cost in the network. As of June 4, 2024, the Thermo Cap Ratio was approximately 21.22, while the Bitcoin price was around $70,500. Historically, the Thermo Cap Ratio has shown peaks during significant Bitcoin price highs and lows during market troughs. Considering the current ratio, Bitcoin's relatively high price is actually grounded in the substantial and continuous flow of investment, indicating that it is not overvalued in the context of historical investment costs and network fundamentals.

Source: CryptoQuant

Ethereum's Surge in Open Interest and Future Potential

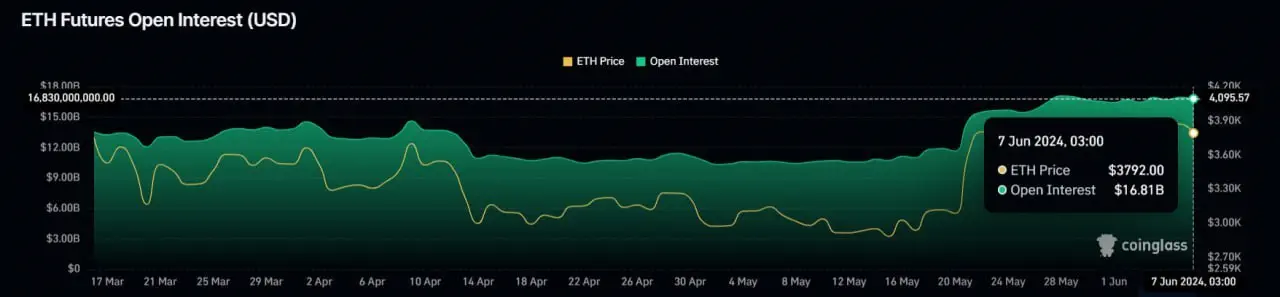

ETH's open interest on exchanges surged to a new all-time high after the SEC’s U-turn towards ETH ETFs, coming in at $16.81 billion as of this writing, according to Coinglass Data.

Source: CoinGlass

Global investment manager VanEck predicts that Ethereum (ETH) will be worth approximately $22,000 by 2030, according to a comprehensive analysis published on June 5. VanEck attributes this high price expectation to Ethereum’s burgeoning role as a high-growth, internet-native commercial system, with the potential to disrupt traditional financial sectors and Big Tech platforms.

Biden's Veto and International Crypto ETF Progress

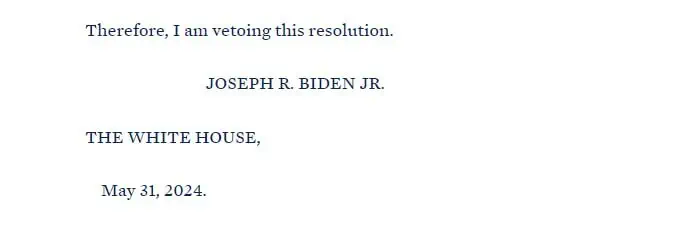

Contrary to expectations sparked by the earlier shift in tone towards crypto, United States President Joe Biden has vetoed a resolution that would have overruled the US Securities and Exchange Commission Staff Accounting Bulletin No. 121, saying he "will not support measures that jeopardize the well-being of consumers and investors."

Source: Whitehouse.gov

The Blockchain Association voiced its discontent after the veto decision was announced. "We’re disappointed that the administration chose to overrule bipartisan majorities in both Houses of Congress who recognized the harm created by SAB 121," the association stated in an X post.

Meanwhile, in an interview with CNBC on Wednesday, SEC Chair Gary Gensler discussed the status of spot ETH ETFs, noting that the agency’s approval would "take some time" for the ETFs to become available on exchanges. He highlighted that the SEC is still working on disclosure measures with exchanges, indicating that S-1 approvals are not imminent. The industry expected trading to begin in a couple of weeks, but now it seems the process will take longer.

Source: CNBC.com

While we're focused on US regulatory developments, lawmakers in other countries are scripting their own crypto regulations. For example, Thailand's SEC has given the green light to the nation's first Bitcoin spot ETF.

Additionally, Australia’s first BTC spot ETF began trading on June 4, reflecting growing acceptance and integration of cryptocurrency investments in global financial markets.

Notable Movements and Initiatives in Bitcoin Mining

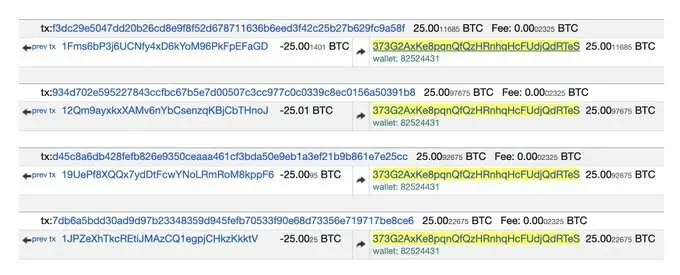

Recently, miner addresses transferred out 100 BTC (approximately $7.05 million as of this writing) after 11 years of inactivity. These miners originally earned 25 BTC each back in 2013, when the total value was approximately $1.75 million. This movement of old Bitcoins highlights the enduring interest and participation of early adopters in the Bitcoin ecosystem.

Bitcoin mining is bursting with fresh excitement, thanks to the surprise entrance of a US politician to the scene. According to US Senator Ted Cruz’s X post, he has purchased three BTC mining ASICs and is now actively mining Bitcoin.

Conclusion

The 13th edition of GoMarket revealed Bitcoin's booming futures open interest and BTC's macro environment looking bright, with investors growing more speculative and seeing rate cuts as a real possibility. Ethereum's prospects also look quite positive with the approval of spot Ether ETFs. Crypto's regulatory journey has been mixed but showing promise, with international regulators making progress. The bitcoin mining community has been intrigued by the foray into Bitcoin mining of a US politician. In light of all this, it seems crypto is no longer the wild child of the world; instead, it’s being normalized in the eyes of politicians, policymakers, and the general public alike. Stay tuned for next week's update where we'll analyze what's brewing in the market and identify new trends before they materialize.