Market Analysis with Mike Ermolaev

Welcome to the 11th edition of GoMarket Weekly! Mike Ermolaev, a crypto expert and journalist, is here to break down the latest developments in the cryptocurrency world exclusively for the GoMining community. It's been quite a busy time—Bitcoin has seen interesting advancements alongside unexpected news from Ethereum. We're also going to look at crucial regulatory shifts accompanied with substantial changes unfolding within the realm of BTC miners. Let's GoMarket!

Bitcoin Pizza Day and Rising Investment Inflows

During the past seven days, Bitcoin has traded within the range of $65,005 - $71,464, narrowing the gap from March 14 ATH to just -8%.

On May 22nd, the crypto community celebrated Bitcoin Pizza Day, marking the historic purchase in 2010 when programmer Laszlo Hanyecz bought two Papa John’s pizzas for 10,000 BTC. Today, those pizzas would be worth a whopping $700 million.

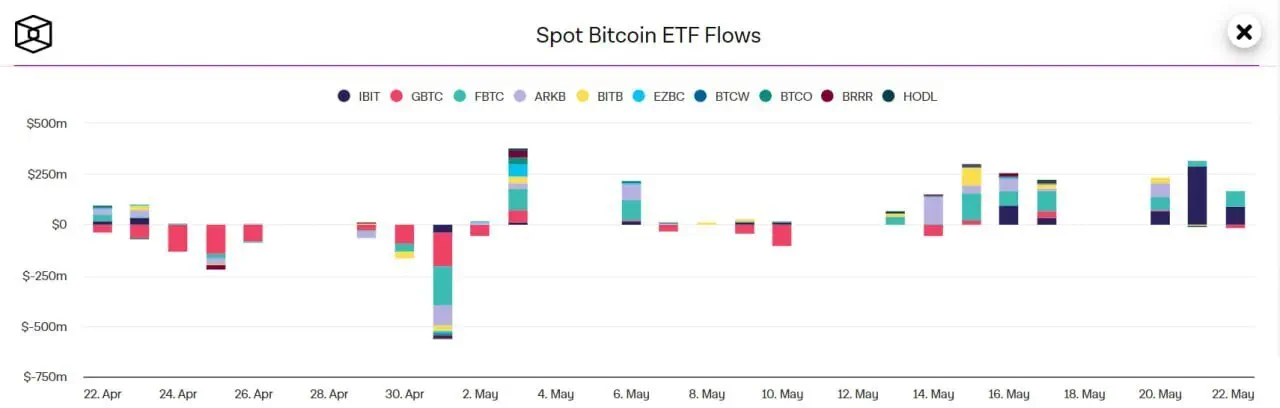

With Bitcoin’s price on the rise and the hype surrounding Ethereum ETFs, US-based Bitcoin ETF funds have started attracting significant investments again. Over the past seven days, there has been a steady inflow of capital, with daily investments exceeding hundreds of millions of dollars, peaking at $315.8 million on May 21st.

Source: TheBlock

SEC Approves Ether ETFs

The US Securities and Exchange Commission (SEC) has approved applications from Nasdaq, CBOE, and NYSE on Thursday to list exchange-traded funds (ETFs) tied to the price of Ethereum (ETH), giving the green light for the products to be traded later this year. Overall, the SEC has approved the following eight Ethereum-based ETFs: Grayscale Ethereum Trust, Bitwise Ethereum ETF, iShares Ethereum Trust, VanEck Ethereum Trust, ARK 21Shares Ethereum ETF, Invesco Galaxy Ethereum ETF, Fidelity Ethereum Fund, and Franklin Ethereum ETF.

ETH prices have increased over the past week, trading between $2,934 - $3,913, pushing higher after the SEC directed issuers of potential ETH-ETFs to update their 19b-4 filings urgently and remove provisions related to staking.

In light of the SEC's approval of 19b-4 forms, the agency is expected to work with Ether ETF issuers on S-1’s over the next few weeks/months. After this, the S-1 registration statements will become effective, at which point trading can begin.

This unexpected turn of events caught a ‘complacent market by surprise’, according to QCP Capital analysts, who predicted that in case the ETH-ETF is approved, Ethereum’s price could soar above $4K in the short term and potentially reach $5,000 later this year.

Analyst James Seyffart from Bloomberg also said this shift took everyone by surprise. Along with many others in the market, he admitted his prediction was off base.

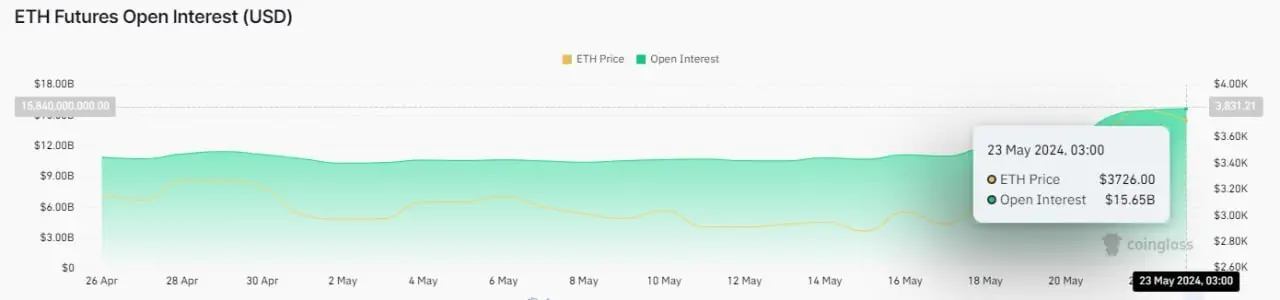

In the midst of this hype, open interest in Ethereum futures reached a record $15.65 billion on May 23rd, an increase of 40% in one week.

Source: CoinGlass

The boost in ETH's futures open interest coupled with a positive funding rate indicates increased investor engagement and overall positivity toward the asset. As of this writing, ETH’s funding rate was 0.011%.

House Passes FIT21; President Biden's Team Switches Tone on Crypto

Meanwhile, US lawmakers took a significant step forward by approving FIT21—this legislation lays out who's responsible for policing cryptocurrencies; effectively shifting main oversight duties from the SEC's jurisdiction mainly to the Commodity Futures Trading Commission (CFTC). With backing from both sides, this legislation saw approval by 208 Republican members alongside 71 Democratic colleagues. In contrast, resistance came primarily from one party as only three GOP members voted against it versus over 133 opposing votes cast by House Dems.

Source: House.gov

This happened despite the SEC releasing a statement right before the vote, where it claimed that FIT21 “would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors and capital markets at immeasurable risk.” This is a rare situation in which a top financial regulator tries altering political tides publicly like this.

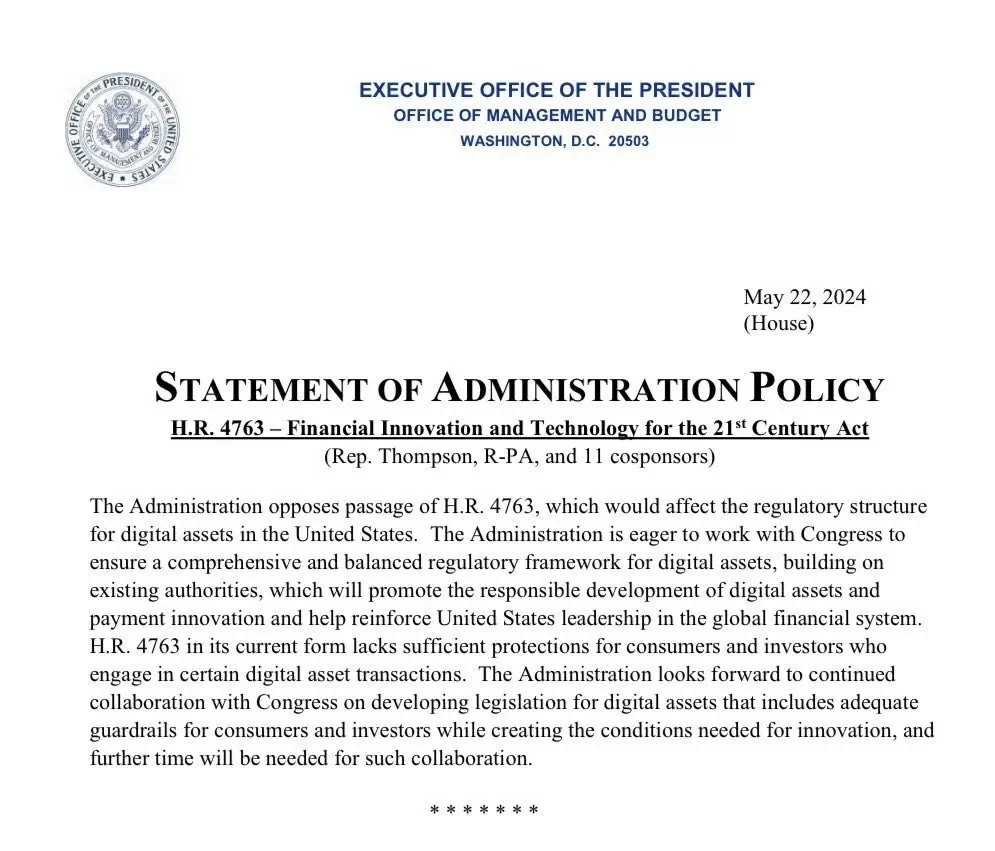

The Biden administration also issued a statement opposing the bill a couple of hours before the vote.

Source: Whitehouse.gov

Even so, we see a changing tone in sentences like “the Administration is eager to work with Congress to ensure a comprehensive and balanced regulatory framework for digital assets” compared to the previous uncompromising statement intending to veto the Senate and House votes to repeal the controversial SEC rule.

Perhaps, Dems realized that harsh anti-crypto rhetoric wouldn't help them in the run-up to the November election. Adding even more fuel to this speculation, Mark Cuban, the billionaire investor, said that an anti-crypto stance could cost Biden the presidency.

Venezuela's Bitcoin Mining Ban

In Venezuela, authorities have announced a Bitcoin mining ban and confiscated over 11,000 miners in response to the nation’s energy crisis, with plans to disconnect all cryptocurrency mining farms from the national grid. This is a stark example that investors of all types—whether large institutions or individuals—need to do their due diligence on a number of fronts before deciding on a mining location. Focusing solely on affordable electricity simply isn't enough – a firm political scene in place along with robust legal support and trustworthy infrastructure are all factors crucial to consider.

Conclusion

In this week’s edition of GoMarket Weekly, we’ve seen Bitcoin gaining momentum amid increased investments and Ethereum navigating a potential regulatory breakthrough. Upcoming legal adjustments in the United States have potential to clarify crypto regulations significantly. Venezuela's mining ban is a clear signal to be extra careful when picking a spot for your mining venture. Watch closely—these ongoing developments will soon change the scene for the entire market. Stay crypto-savvy, and see you next week!