Market Analysis with Mike Ermolaev

Welcome to the tenth edition of GoMarket Weekly where a go-to crypto analyst and journalist Mike Ermolaev breaks down the latest happenings in the cryptocurrency world for the GoMining community. This week, we’ve seen Bitcoin bouncing back from the recent weakness, while Ethereum was failing to keep up with its rival’s pace. Also, there have been some major regulatory moves as well as changes in the Bitcoin mining sector. Read on to discover the key factors driving recent market behavior and catch up on the latest major developments, conveniently gathered and explained in this article.

Bitcoin on the Rise Amid Fed Rate Cut Expectations

Over the past 7 days, the price of Bitcoin has been fluctuating between $60,380 –$66,517, currently resting just 10% away from its March all-time high. The upswing in the original cryptocurrency’s value occurred following the release of the latest US Consumer Price Index (CPI) report showing core inflation at a three-year low. People are getting their hopes up over expectations that the Federal Reserve might soon lower interest rates, thus opening the floodgates for liquidity to flow into alternative assets—crypto included.

Reflecting this optimism, there has been a surge in requests to recover access to stranded Bitcoin wallets. For example, Germany-based ReWallet reported a 334% increase in requests last quarter, setting a record high in early March when Bitcoin prices peaked. The firm estimates that about 20% of the total BTC in circulation is likely inactive. Similarly, US-based wallet recovery services saw a 30% rise in requests so far this year (as of mid-April).

Ethereum Stuck in Regulatory Limbo

While Bitcoin’s is bouncing back, Ethereum isn’t seeing the same kind of action. It appears that the second largest cryptocurrency by market cap is experiencing a bit of uncertainty as market participants await a decision from the Securities and Exchange Commission (SEC) on May 23 whether to approve VanEck's spot Ethereum ETF.

Scott Johnsson, an Associate at Davis Polk and Wardwell reviewed a filing from BlackRock to list its Ether ETF on the Nasdaq, in which the SEC seeks public input on whether this investment should be classified as a commodity. Johnsson thinks the SEC’s purpose is “to potentially deny on the basis that these spot filings are improperly filed as commodity-based trust shares and do not qualify if they are holding a security.” He claims the question was never asked before spot Bitcoin ETFs were approved.

Senate Passes Bill to Overturn SEC Crypto Custody Rule, House to Review FIT21 Act

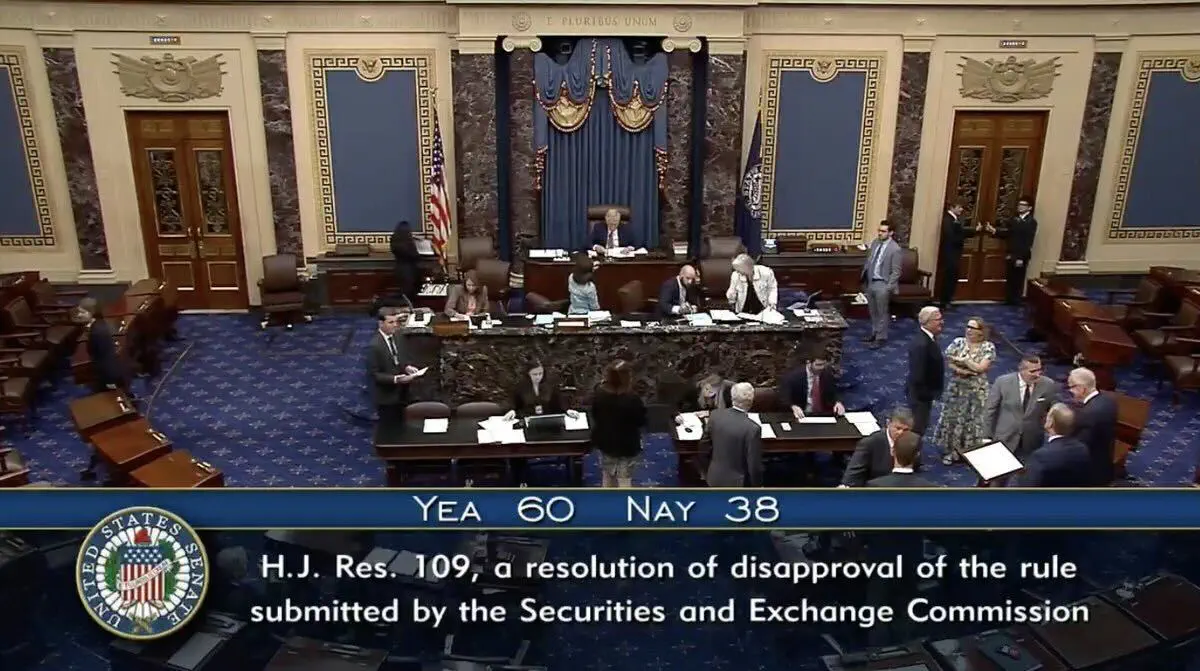

In a significant step forward on the regulatory front, the Senate has passed H.J.Res. 109, a bill, previously supported by the House, to overturn the SEC's Staff Accounting Bulletin No. 121, which restricts financial institutions from keeping Bitcoin and other cryptocurrencies in their custody.

Source: Senate.gov

With a strong show of unity, lawmakers sent their approval signal loud and clear – hitting a tally mark of 60 yes votes against 38 no votes. Up ahead lies its final hurdle; now it heads to President Biden, who has threatened to veto it.

There is no doubt that SAB 121 is a barrier to the growing demand for Bitcoin services, and overturning it is essential to reducing centralization-related risks. However, if the US president says no, it'll take a whopping two-thirds majority in both chambers to override it. But in case the bill does become law, highly regulated traditional banks will step into the crypto world to offer their custody services for Bitcoin and other cryptocurrencies. In turn, this would elevate crypto’s credibility and attract a wave of new investors.

Meanwhile, the House Committee on Rules is set to look at the Financial Innovation and Technology for the 21st Century (FIT21) Act (H.R. 4763), potentially bringing it to a floor vote later in May. The potential passage of this US bill is crucial. It gives the Commodity Futures Trading Commission (CFTC) new jurisdiction over digital goods and clarifies the Securities and Exchange Commission’s (SEC) jurisdiction over digital assets offered under an investment treaty.

Oklahoma's New Mining Law, El Salvador's Geothermal Success, and Miner Challenges

Among the latest Bitcoin mining developments, Oklahoma has passed a new bill that establishes legal protections and a regulatory framework for cryptocurrency miners. Thanks to new regulations, crypto mining efforts are safeguarded under state law now. For crypto mining worldwide, this could be a catalyst for other regions to embrace similar frameworks.

In the meantime, El Salvador keeps pushing forward, having mined around 470 bitcoins since 2021 using a geothermal power plant fueled by the country’s Tecapa volcano, according to the official data from the country's "Bitcoin Office," an official government entity. As of today, El Salvador holds 5,752 Bitcoins.

On the flip side, analysis by Kaiko Research shows Bitcoin miners are grappling with lower profits due to reduced transaction fees. According to it, after a temporary spike post-halving, fees have decreased, increasing the financial pressure on miners. If miners start to sell off their Bitcoin to cover their operational costs, it might affect market prices. As some major mining companies hold significant amounts of Bitcoin, any forced sales could have notable effects on the crypto market. Also, during the summer, trading activity and liquidity is often lukewarm, adding to these difficulties. Even so, this appears to be a temporary situation.

Conclusion

In this week's edition of GoMarket Weekly, we've seen Bitcoin recovering amid hopes of Federal Reserve rate cuts, which is evidently seen in a surge in wallet recovery requests. At the same time, Ethereum was facing uncertainty in the wake of the SEC decision. Regulatory developments like the Senate's passage of H.J.Res. 109 and the potential FIT21 Act could reshape the crypto landscape, bringing clarity and encouraging institutional investment. Over in Oklahoma and down to El Salvador, fresh laws and clever innovations are shaking up the global scene of crypto mining. Stay tuned – these evolving trends are about to make waves and dramatically alter the market landscape before you know it.